Guide to Getting Started in the Crypto World

Buying Bitcoin can seem like a complicated task, especially depending on the country you live in. For example, currently, the only country where Bitcoin is legal tender is El Salvador. In the rest of the world, its legal status varies, and you may encounter resistance from both banks and centralized exchanges.

In this article, I explain Bitcoin in simple terms, how to buy it, and the precautions you should take before and after acquiring it.

What is Bitcoin, and why is there still resistance from banks to this day?

Bitcoin (BTC) is a decentralized digital currency created in 2009 by a person (or group) under the pseudonym ” Satoshi Nakamoto .” To this day, the true identity of its creator remains unknown. Still, the digital currency has solidly established itself in the market, despite lacking backing from any public or private institution, person, economy, or country.

Unlike traditional currencies (issued by central banks), Bitcoin is not controlled by any bank or government and is based on a peer-to-peer network that validates all transactions using the blockchain. This is a double-edged sword, as it cannot be manipulated directly, but it can be manipulated indirectly.

The resistance from banks and governments is due to several reasons:

- Loss of control: Bitcoin enables transfers without intermediaries, which puts the control of traditional financial institutions at risk.

- Money laundering risks: Your privacy has raised concerns about its use in illegal activities or tax evasion.

- Volatility: Bitcoin’s price can change dramatically in a short period, making it a risky investment for uninformed users. This means that markets can alter their value (both positively and negatively), for example, through wars, conflicts between influential countries, US elections, fluctuations in commodity prices, changes in stock markets, pandemics, and other factors.

- Challenge to the current system: By not requiring banks, Bitcoin represents an entirely new financial model that runs counter to the traditional financial system. This creates resistance from banks or financial institutions, as I mentioned earlier, due to both its volatility and its lack of ties to specific countries, institutions, and other factors.

How does Bitcoin work?

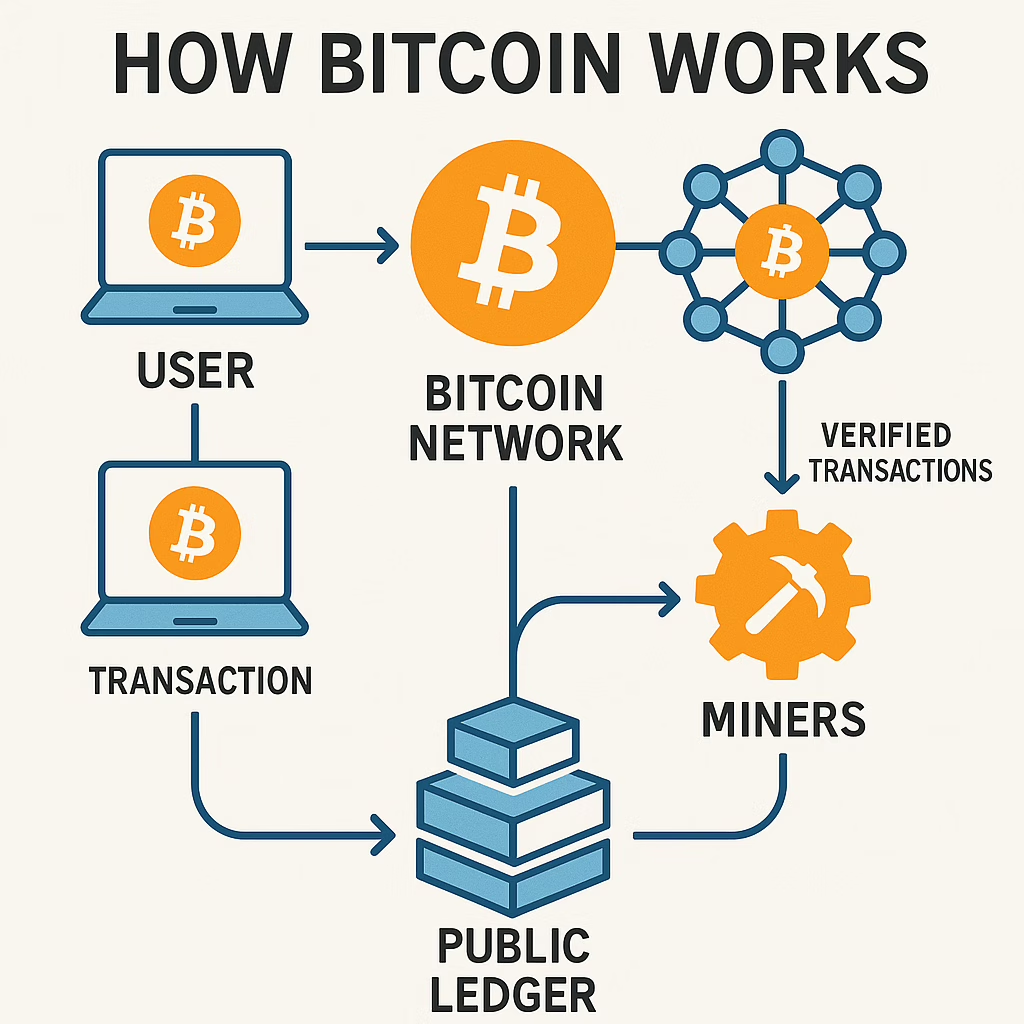

In the following diagram, I explain how Bitcoin works

USER:

A user initiates a Bitcoin transaction from their computer or device.

BITCOIN NETWORK:

The transaction is sent to the decentralized Bitcoin network.

MINERS:

Miners receive transactions and verify them through a process of solving complex mathematical problems (proof of work).

VERIFIED TRANSACTIONS:

Once verified by miners, transactions are considered valid.

PUBLIC LEDGER:

Verified transactions are added to the public ledger (the blockchain), a publicly accessible database that records all Bitcoin transactions.

The Evolution of Bitcoin: From Cents to Hundreds of Thousands of Dollars

When Bitcoin was born in 2009, it had virtually no commercial value . Its creator, Satoshi Nakamoto, released the first block (known as the genesis block ) as a proof of concept for a digital decentralized monetary system.

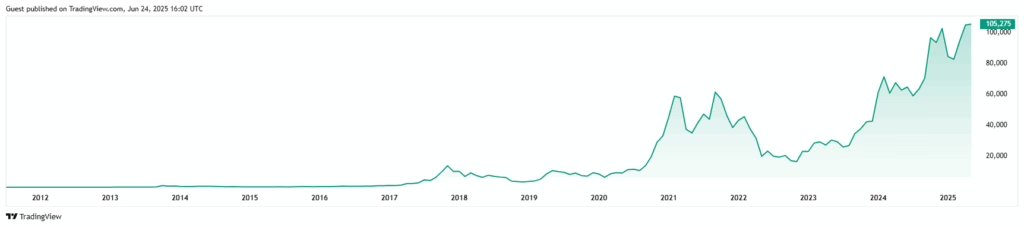

Here’s a brief chronology of Bitcoin’s exponential growth:

- 2010: The first commercial transaction using Bitcoin takes place: 10,000 BTC is exchanged for two pizzas. At the time, 1 BTC was worth approximately $0.003 USD.

- 2013: Bitcoin reaches $1,000 USD per unit for the first time. This was a turning point that attracted the attention of the media and regulators.

- 2017: Amid crypto fever, the price of BTC skyrockets to almost $20,000 USD in December.

- 2020–2021: During the pandemic, Bitcoin was adopted by institutional investors as a store of value. In November 2021, it reached its all-time high (ATH) of approximately $69,000 USD.

- 2022–2023: The market undergoes a sharp correction, falling to levels between $16,000 and $25,000 USD. Still, interest persists.

- 2024–2025: The ecosystem continues to mature. Major companies accept payments in BTC, and the narrative of Bitcoin as “digital gold” strengthens.

- 2025 – Currently ,the price ranges from $90,000 to more than $100,000

Beyond price: growth in adoption

- More than 400 million people around the world have interacted with cryptocurrencies.

- To date, only El Salvador has adopted Bitcoin as legal tender.

- Global companies such as Tesla, MicroStrategy, and PayPal have invested in or allow trading in BTC.

- The infrastructure has improved: there are BTC ATMs , accessible apps, and the Lightning Network , which allows for instant and low-cost transactions.

Bitcoin is no longer just a niche idea. It’s a global network that has evolved from an internet curiosity to a new class of financial asset with revolutionary potential .

What is a Central Exchange?

A central exchange (CEX) is a platform that facilitates the purchase and sale of cryptocurrencies using traditional currencies (such as dollars or euros). Some popular examples include:

Unlike decentralized systems, CEXs operate as intermediaries and require you to trust them to store your funds and execute your buy/sell orders. Many even require identity verification (KYC) , especially if you plan to move large amounts of money.

A CEX isn’t necessarily a “crypto bank,” even though it may appear to be one. All CEXs charge a commission when buying and selling; this is how they make money.

Personally, the CEX I have been able to use in Costa Rica is CEX.IO , it is a secure platform that deposits sales directly to your credit card, as long as your bank allows it.

How can you buy Bitcoin?

Depending on your country and whether your bank allows it, you have several ways to acquire Bitcoin:

- Centralized Exchanges (CEXs)

Sign up, verify your identity, and transfer funds from your bank account. You can then buy Bitcoin with a credit card, bank transfer, or even PayPal (in some cases). - Peer-to-Peer (P2P) Platforms:

Sites like Paxful or LocalBitcoins allow you to buy Bitcoin directly from other people, using various payment methods. This can be useful if your bank doesn’t allow transactions with exchanges. - Bitcoin ATMs (BTC ATMs)

In some cities, there are ATMs where you can deposit cash and receive BTC in your digital wallet. They usually charge higher fees, but offer anonymity. - Financial apps with crypto support

Some fintechs like Revolut or Strike (in El Salvador) allow you to buy small amounts of BTC easily.

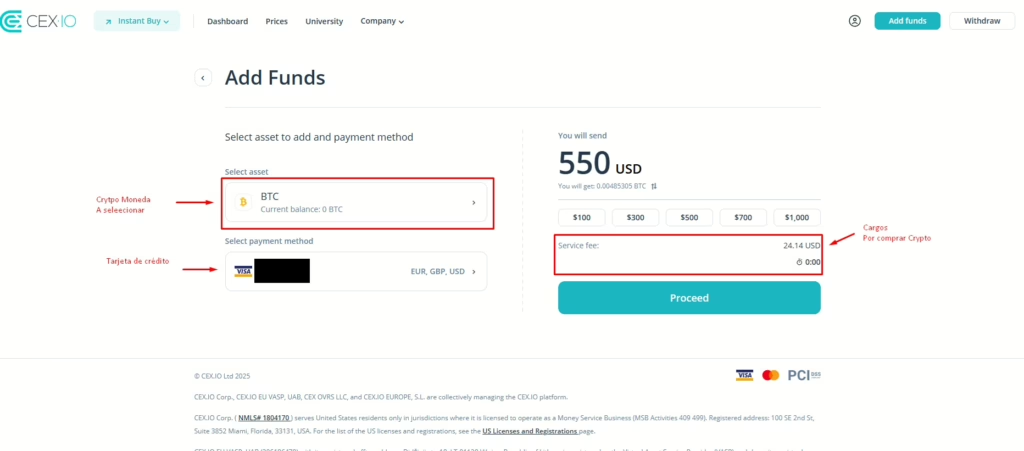

Buy it with CEX.IO

1 – To purchase a cryptocurrency with CEX.IO , you must first create an account and then complete the KYC process. If you’re not sure how to complete it, read this official guide from the exchange: https://support.cex.io/en-us/articles/4383395-account-verification-guide-identity-verification

2- Add funds to your electronic wallet and select the currency to buy, in this case it is BTC (for Bitcoin)

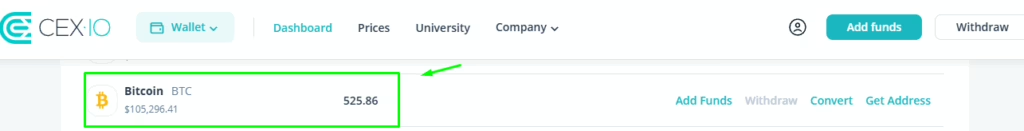

3- Once the payment is complete, the selected amount should appear in your digital wallet under your account balance.

Can you mine it?

Yes, mining Bitcoin is another way to earn it, but it’s neither easy nor cheap. It involves:

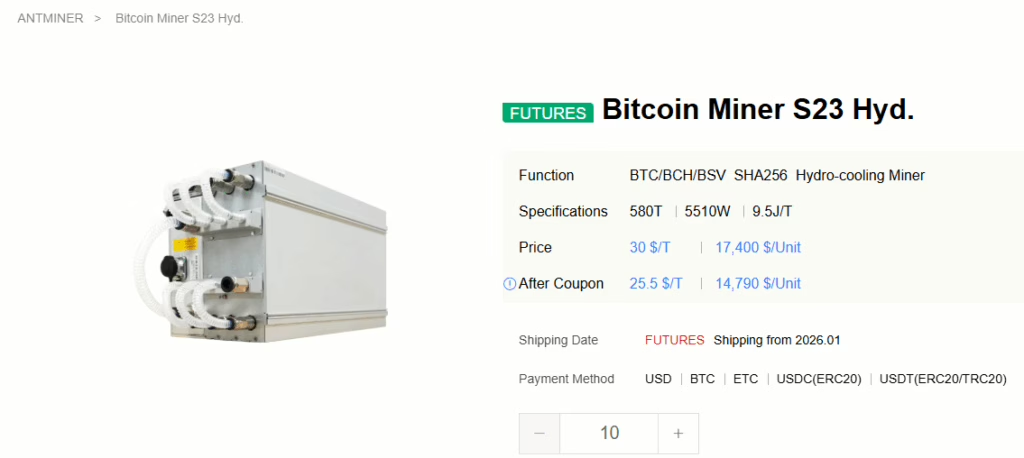

- Having specialized equipment (ASICs) that consume a lot of electricity and whose cost varies, but can usually cost thousands of dollars.

- Invest in infrastructure and cooling to mine at scale.

Nowadays, home mining is no longer profitable for most people , unless you live in a country with cheap energy. However, you can join mining pools or use cloud mining services , though you should be wary of scams.

Conclusion

Buying cryptocurrency carries significant risks. Never invest money you aren’t willing to lose completely, as these assets can lose substantial value in the short term.

It is also true that its value can increase exponentially, but as we have already seen, this depends on multiple economic, political and technological factors.

In the case of Bitcoin, it has demonstrated remarkable resilience and consistency over time, consolidating itself as the most stable digital asset in the ecosystem, but that does not imply that this will ever change.

From my personal experience, I only recommend considering buying Bitcoin, and I do not recommend getting involved in mining if you do not have a considerable initial investment, since ASICs have a very high cost, both in acquisition, maintenance, and energy consumption.

Finally, I don’t recommend buying Bitcoin to sell it in the short term . Its historical tendency has been to increase in value over the years, so it’s generally more appropriate to view it as a long-term investment. Remember to only buy cryptocurrencies with money you’re willing to lose. Don’t leverage loans or credit cards to buy a currency that can lose value exponentially in a short time.

⚠️ Important Note:

This article is for informational and educational purposes only. It does not constitute financial, legal, or investment advice. Each person is responsible for their own decisions and should conduct their own research before investing in Bitcoin or any other cryptocurrency. Cryptocurrency carries significant risks , including the possible total loss of your invested capital. If you have any questions, consult a professional financial advisor.

🔗 Content Transparency:

Some links in this article, like the one to CEX.IO , are affiliate links . This means that if you click through and make a purchase or register, we may receive a small commission, at no additional cost to you. This commission helps us continue creating free, quality content. We always recommend that you do your own research before making any financial decisions.

Director and Co-Founder of GoodGameDaily.com

Andrés Rodríguez Paniagua is a Systems Engineer with a Bachelor’s Degree in Web Development and a Master’s Degree in Project Management. He works as a Technology Product Manager at a multinational company, driving innovation and product strategy. As Director and Co-Founder of GoodGameDaily.com, he combines his passion for video games, technology, and digital media to build a platform for engaging content and community growth.